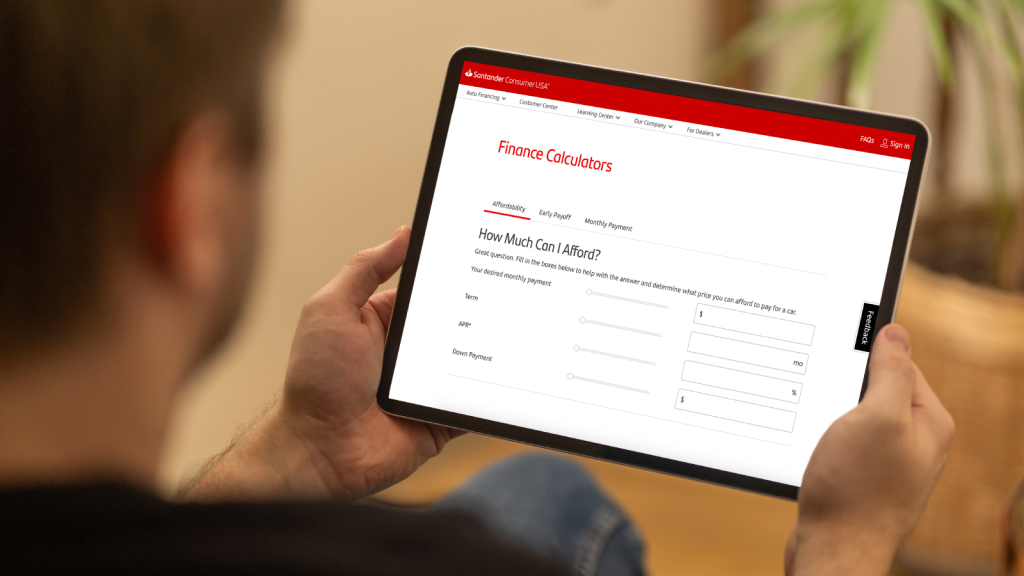

Financing a car can feel overwhelming—but it doesn’t have to be. Santander Consumer USA makes the process smoother, especially for drivers who want straightforward options and real support. Whether you’re buying your first car, upgrading to a family-friendly SUV, or just looking for a monthly payment that fits your budget, Santander is ready to help.

With flexible terms and access to a broad dealership network, Santander works with borrowers across the credit spectrum. Their easy pre-qualification tool gives you a head start—showing you possible terms without affecting your credit. From there, their Drive® platform connects you with participating dealerships and streamlines the process of getting behind the wheel.

Why People Trust Santander for Auto Loans

- Easy pre-qualification – Just a few questions online and you’ll see potential offers—no credit impact.

- Loans for all credit profiles – Whether your credit is excellent or still in progress, you’ll find tailored solutions.

- Fast approvals – Dealerships submit applications directly to Santander, often delivering same-day results.

- Helpful tools and support – Use MyAccount to manage payments, set reminders, or enroll in AutoPay.

- Plenty of dealer partners – Choose from thousands of new and used cars across the U.S.

- Refinance options available – Already have a car loan? Santander may be able to help lower your rate or payment.

Who Should Consider Santander?

✅ Drivers who want a quick pre-qualification with no credit impact

✅ Buyers with fair, average, or limited credit histories

✅ People who prefer shopping at dealerships with in-house finance help

✅ Those who appreciate digital tools and self-service account management

✅ Borrowers looking for refinancing flexibility or second-chance financing

What to Know Before You Apply

- This is dealer-based financing – You’ll complete your application at a Santander-partner dealership.

- Pre-approval isn’t final – Your final terms depend on the vehicle you choose and your full credit review.

- Minimum income and down payment may apply – Requirements vary based on credit and loan amount.

- Vehicle restrictions exist – Generally, vehicles must be under 10 years old and meet mileage limits.

- Proof of insurance required – You’ll need full coverage before finalizing your loan.

- Drive® pre-qualification is valid for 30 days – Be ready to shop soon after checking your offer.

- Not for private sales – You’ll need to buy from a licensed dealer that works with Santander.

How the Santander Auto Loan Process Works

- Start with Drive

Go online and complete a quick form to check if you pre-qualify. - Explore dealerships

Use your Drive approval to visit partner dealers and shop within your budget. - Choose your car

Whether new or used, select a vehicle that fits your lifestyle and loan amount. - Submit your full application

At the dealership, the finance department will handle the details. - Review and sign

Once approved, review your loan offer and sign the paperwork. - Drive home

Enjoy your new car, knowing you’ve secured financing designed for you. - Stay on top of your loan

Use the MyAccount portal or mobile app to pay your bill, set up AutoPay, and track your progress.